Welcome to the dynamic realm of market analysis, where understanding the Guppy Multiple Moving Average (GMMA) can be your key to success. In this comprehensive guide, we’ll unravel the intricacies of GMMA, offering you a deep dive into its significance, applications, and the expertise required to leverage it for informed decision-making.

The Guppy Multiple Moving Average (GMMA): A Closer Look

What is The Guppy Multiple Moving Average (GMMA)?

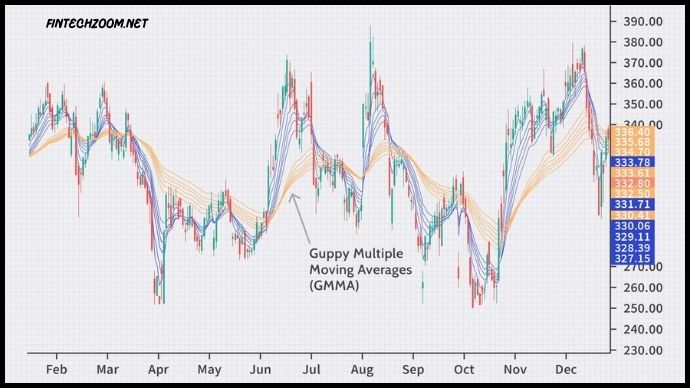

The Guppy Multiple Moving Average (GMMA) is a powerful tool used in technical analysis to gauge the strength of a trend and identify potential trend reversals. Unlike traditional moving averages, GMMA comprises both short-term and long-term moving averages, offering a holistic view of market trends. Traders often rely on GMMA to make informed decisions, aligning their strategies with the prevailing market sentiment.

Unveiling the Components of GMMA

Understanding GMMA involves delving into its components. The short-term moving averages capture recent market fluctuations, providing a snapshot of immediate trends. On the other hand, long-term moving averages offer a broader perspective, smoothing out noise and revealing the underlying market direction. Together, these components create a comprehensive analysis tool that adapts to varying market conditions.

Applying GMMA in Real-world Scenarios

Successful traders harness the power of GMMA to navigate the complexities of financial markets. By analyzing the convergence and divergence of short-term and long-term moving averages, traders can identify potential entry and exit points. GMMA is particularly effective in trending markets, providing valuable insights into the strength and sustainability of a trend.

Leveraging GMMA for Informed Decision-making

Integrating GMMA into Your Trading Strategy

Incorporating GMMA into your trading strategy requires a nuanced understanding of its signals. A bullish signal occurs when short-term moving averages cross above long-term ones, indicating a potential uptrend. Conversely, a bearish signal manifests when short-term averages cross below long-term ones, signaling a possible downtrend. By aligning your trades with these signals, you can enhance the precision of your market entries and exits.

Realizing the Power of GMMA in Risk Management

Beyond trend analysis, GMMA serves as a valuable tool for risk management. Traders can set stop-loss levels based on the insights provided by GMMA, mitigating potential losses in volatile market conditions. This risk-aware approach adds a layer of control to trading strategies, contributing to overall portfolio stability.

FAQs

How does GMMA differ from traditional moving averages?

GMMA stands out by incorporating both short-term and long-term moving averages, providing a more comprehensive analysis of market trends compared to traditional moving averages.

Can GMMA be applied to different financial instruments?

Yes, GMMA is versatile and can be applied to various financial instruments, including stocks, forex, and commodities.

Is GMMA suitable for both short-term and long-term traders?

Absolutely. GMMA’s adaptability makes it suitable for traders with different time horizons, offering insights into both short-term fluctuations and long-term trends.

How frequently should traders monitor GMMA signals?

The frequency of monitoring GMMA signals depends on the trading style. Short-term traders may check more frequently, while long-term investors can adopt a more relaxed approach.

Are there any limitations to GMMA analysis?

While powerful, GMMA is not foolproof. Traders should use it in conjunction with other analysis tools and consider market fundamentals for a holistic approach.

Can GMMA be customized based on individual preferences?

Yes, traders can customize GMMA parameters based on their preferences and risk tolerance, allowing for a personalized trading experience.

Conclusion

Mastering the Guppy Multiple Moving Average (GMMA) opens the door to a world of nuanced market analysis. By understanding its components, applying it judiciously in trading strategies, and integrating it into risk management, you can elevate your trading game. Stay ahead of market trends, make informed decisions, and embark on a successful trading journey with the powerful insights offered by GMMA.