In an era dominated by digital advancements, Regions Online Banking emerges as a financial game-changer, bringing convenience, security, and innovation to your fingertips. This comprehensive guide explores the multitude of features and benefits that make Regions Online Banking a preferred choice for modern consumers.

Convenience at Your Fingertips

User-friendly Interface

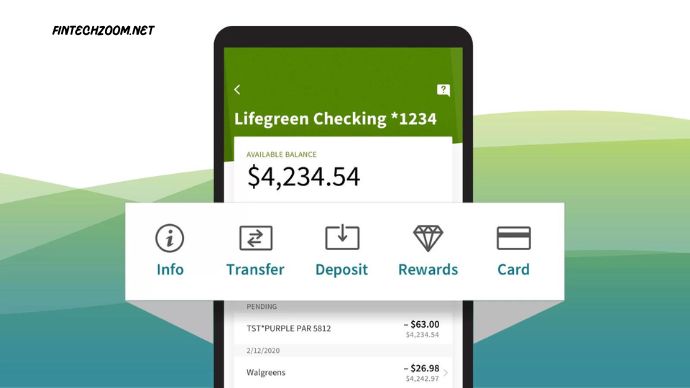

Regions Online Banking welcomes users with an intuitive interface, ensuring a hassle-free banking experience. Navigating through your accounts, making transactions, and accessing financial information becomes a breeze.

Mobile Banking Advantages

With Regions’ mobile app, your bank goes wherever you go. Enjoy the flexibility of managing your finances on the go, making transactions, and staying informed about your accounts with ease.

Security Measures

Multi-factor Authentication Regions prioritizes your security. Multi-factor authentication adds an extra layer of protection, ensuring that your account remains secure even in the face of potential threats.

Encryption and Secure Transactions Rest easy knowing that every transaction you make through Regions Online Banking is encrypted, safeguarding your sensitive information from unauthorized access.

24/7 Account Access

Managing Finances Anytime, Anywhere Regions Online Banking breaks the barriers of traditional banking hours. Access your accounts, check balances, and conduct transactions 24/7, providing unparalleled flexibility and control.

Real-time Transaction Monitoring Stay in the loop with real-time transaction monitoring. Receive instant updates on your account activities, enhancing your financial awareness and security.

Flexible Account Management

Customizable Alerts and Notifications Tailor your banking experience with customizable alerts. Receive notifications for transactions, low balances, and more, empowering you to stay on top of your financial health.

Budgeting Tools and Financial Insights Regions Online Banking goes beyond transactions. Benefit from budgeting tools and financial insights, assisting you in making informed decisions and achieving your financial goals.

Cost-Efficient Banking

Fee Transparency and Reduced Costs Regions believes in transparency. Experience fee clarity, reduced costs, and the overall financial efficiency that comes with Regions Online Banking.

Benefits of Paperless Transactions Go green and enjoy the convenience of paperless transactions. Statements, receipts, and documents are all accessible online, contributing to a sustainable and clutter-free banking experience.

Advanced Technology Integration

AI-driven Customer Support Regions goes the extra mile with AI-driven customer support. Experience prompt and efficient assistance, enhancing your overall banking experience.

Integrations with Third-Party Apps Regions Online Banking seamlessly integrates with third-party apps, offering you a holistic financial management experience.

Personalized Customer Experience

Tailored Product Recommendations Regions understands your unique financial needs. Benefit from personalized product recommendations that align with your financial goals and lifestyle.

Responsive Customer Service In the rare event of issues, Regions Online Banking offers responsive customer service, ensuring your concerns are addressed promptly and effectively.

Online Education and Resources

Tutorials and Guides for Banking Features Navigate the diverse features of Regions Online Banking effortlessly with tutorials and guides tailored for users of all levels.

Financial Planning Resources Empower yourself with financial planning resources available on the platform, assisting you in making informed decisions about your money.

Community Engagement

Online Forums and Community Events Connect with fellow users through online forums and community events hosted by Regions, fostering a sense of belonging and shared financial knowledge.

Social Responsibility Initiatives Regions Online Banking doesn’t just serve customers; it serves communities. Explore the platform’s social responsibility initiatives that make a positive impact beyond banking.

Customer Reviews and Testimonials

Positive Experiences Shared by Users Real users share their positive experiences with Regions Online Banking, highlighting the platform’s strengths and benefits.

Addressing and Improving Upon Negative Feedback Regions values feedback. Learn how the platform addresses and continually improves upon negative feedback, ensuring a customer-centric approach.

Future Innovations

Upcoming Features and Improvements Get a sneak peek into the future of Regions Online Banking. Explore upcoming features and improvements that promise to elevate your banking experience.

Technology Roadmap for Regions Online Banking Regions is committed to innovation. Delve into the technology roadmap that outlines the exciting developments planned for Regions Online Banking.

Comparative Analysis

How Regions Online Banking Stacks Up Against Competitors In this section, we conduct a comparative analysis, showcasing the unique strengths that set Regions Online Banking apart from its competitors.

FAQs

How secure is Regions Online Banking?

Regions Online Banking employs robust security measures, including multi-factor authentication and encryption, ensuring your accounts remain highly secure.

What should I do if I suspect unauthorized access to my account?

If you suspect any unauthorized access, contact Regions’ customer support immediately for swift assistance in securing your account.

Can I trust online transactions with Regions?

Absolutely. Regions ensures the security of your online transactions through advanced encryption and real-time monitoring.

Are my personal details safe with Regions Online Banking?

Yes, Regions prioritizes the confidentiality of your personal information, employing industry-standard security measures to safeguard your data.

How often should I update my passwords for Regions Online Banking?

For enhanced security, it’s recommended to update your passwords regularly, preferably every three to six months.

What measures does Regions take to prevent fraud?

Regions employs a comprehensive set of measures, including transaction monitoring and alert systems, to prevent and detect fraudulent activities.

How to Get Started

Step-by-Step Guide to Setting Up Regions Online Banking

- Visit the Regions website or download the mobile app.

- Click on the “Open an Account” or “Log In” button.

- Follow the on-screen instructions to create an account or log in if you’re an existing user.

- Complete the verification process.

- Set up your account preferences, including security settings and notifications.

- Explore the features and start managing your finances online.

Troubleshooting Tips

Common Issues and Their Solutions

- Login Issues:

- Double-check your credentials and ensure you have a stable internet connection.

- Transaction Not Going Through:

- Verify your account balance and ensure you have entered the correct recipient details.

- Technical Glitches:

- Clear your browser cache or update the mobile app to resolve technical glitches.

Conclusion

Regions Online Banking stands as a beacon of innovation and customer-centricity in the realm of digital banking. From robust security measures to personalized financial insights, Regions Online Banking offers a comprehensive suite of features designed to empower users on their financial journey.

Remember, embracing the future of banking starts with Regions Online Banking. Join the community of satisfied users today and experience a new era of seamless, secure, and convenient financial management.