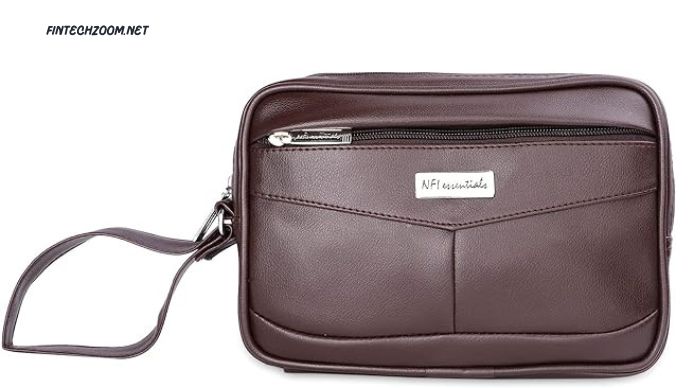

Embarking on a journey toward financial stability requires a deep understanding of Money Bag Essentials. In this guide, we will explore crucial aspects, providing valuable insights and expert advice to help you navigate the intricate path of managing your finances effectively.

Money Bag Essentials

The Core Components

Embarking on your financial journey begins with understanding the core components of Money Bag Essentials. These encompass income generation, smart budgeting, strategic investments, and emergency funds.

Strategic Investments

Dive into the world of strategic investments, exploring avenues beyond traditional savings. Uncover the power of diverse investment portfolios and how they contribute to long-term financial growth.

Crafting a Solid Foundation

Budgeting Basics

Master the art of budgeting to take control of your financial destiny. Learn practical tips on creating and maintaining a budget that aligns with your goals and aspirations.

Emergency Funds

Explore the significance of emergency funds and how they act as a financial safety net during unforeseen circumstances. Discover the ideal amount to set aside for a secure financial cushion.

Invest Wisely

Diversification

Delve into the concept of diversification and its role in minimizing risk while maximizing returns. Understand how a well-diversified portfolio can be your shield against market fluctuations.

Long-Term Planning

Unlock the secrets of successful long-term financial planning. Gain insights into creating a roadmap that ensures a prosperous future and financial well-being.

Debunking Financial Myths

Common Misconceptions

Separate fact from fiction as we debunk prevalent financial myths. Identify and overcome common misconceptions that might hinder your journey to financial success.

Importance of Financial Literacy

Highlighting the significance of financial literacy, explore how being well-informed empowers individuals to make sound financial decisions.

Securing Your Future

Retirement Planning

Navigate the complexities of retirement planning, ensuring a comfortable and stress-free post-work life. Learn about retirement accounts, investments, and strategies for a secure future.

Insurance Coverage

Understand the importance of insurance in safeguarding your financial interests. Explore various insurance types and how they contribute to financial security.

Navigating Economic Changes

Adapting to Market Trends

Equip yourself with the knowledge to adapt to ever-changing market trends. Discover strategies to thrive, not just survive, in dynamic economic conditions.

Financial Resilience

Develop financial resilience to weather economic storms. Learn how to build a robust financial foundation that withstands challenges and uncertainties.

Money Bag Essentials in Action

Success Stories

Read inspiring success stories of individuals who mastered Money Bag Essentials. Gain motivation and insights into real-world strategies that led to financial prosperity.

Real-world Strategies

Implement practical strategies derived from real-world experiences. Learn how these strategies can be tailored to your unique financial goals.

FAQs

Emergency Funds: How much is enough?

Explore guidelines on determining the optimal amount for your emergency fund, ensuring financial security in unexpected situations.

Investment Risks and Rewards

Understand the risks and rewards associated with investments. Discover how to make informed decisions that align with your risk tolerance and financial goals.

The Impact of Economic Downturns

Learn about the impact of economic downturns on your finances and how to navigate challenging times while preserving your financial well-being.

Achieving Financial Freedom

Uncover the steps towards achieving financial freedom. Gain insights into building wealth and creating a life that aligns with your aspirations.

Common Budgeting Mistakes to Avoid

Identify common budgeting pitfalls and learn how to avoid them. Enhance your budgeting skills to optimize financial resources effectively.

Importance of Regular Financial Checkups

Discover the importance of regular financial checkups. Learn how consistent monitoring and adjustments contribute to long-term financial success.

Conclusion

Wrap up your journey through Money Bag Essentials by embracing financial empowerment. Implement the knowledge gained to foster a secure and prosperous financial future.